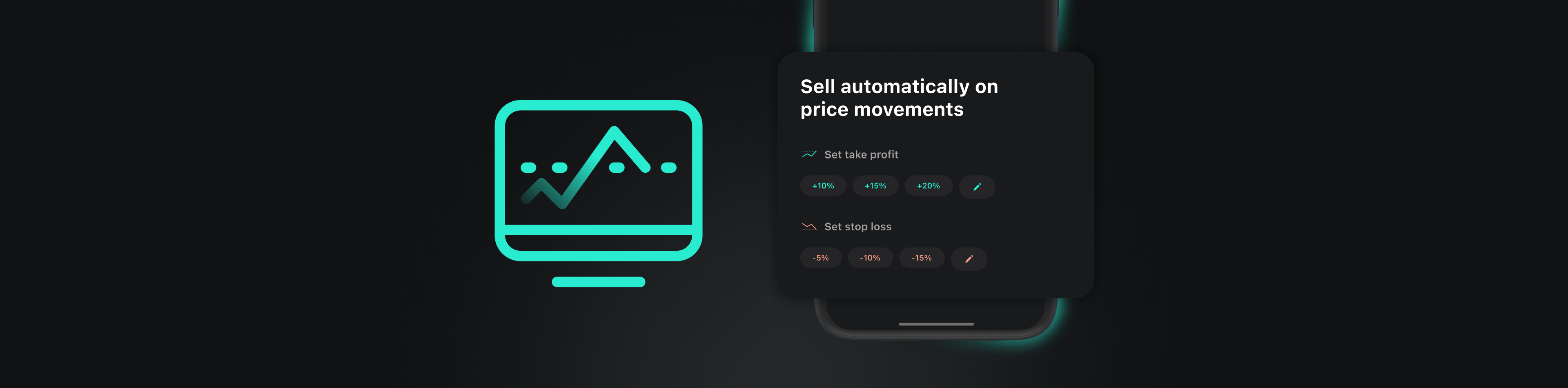

Order executed - now what? You can now ensure that potential profits are realized or losses limited. This saves you time and nerves. You can set a take-profit and stop-loss order for your security immediately after the purchase. No need to keep an eye on the price movements.

What is a take-profit order and what is it good for?

The take-profit order is a limit order that lets you set a price at which a security will be automatically sold. For example, if the price is 10%, 15% or 20% higher than the current price.

If the price of the security does not reach your specified limit price, the take-profit order is not triggered.

The aim is to realize potential profits before the price falls again.

Example:

The current price of a security is €10 per share. If you have set a take-profit order of 20%, the security will be sold automatically as soon as the price has reached €12.

What is a stop-loss order and what is it used for?

With a stop-loss order, you set a stop price below the current price of the security. This price is the lowest price at which you would like to sell and limit further losses.

Like this you can control the maximum loss you may endure with a given security.

If the price of the security does not reach your specified stop price, the order is not triggered.

Can I set up take-profit or stop-loss orders for securities I already bought?

Yes, you can. To get started click the Sell button in the detail view of the security you want to set-up an order for. Define the target amount or the number of shares to be sold. Subsequently use the steps outlined below:

1. How-to set up a take-profit order

- Add a limit price, i.e. the highest price you expect that share to achieve and at which you want to sell.

- Click Sell to create a pending sell order with a limit price (take-profit order).

- The order will be executed automatically, once the security price reaches the specified limit.

Risk Disclaimer – There are risks associated with investing. The value of your investment may fall or rise. Losses of the capital invested may occur. Past performance, simulations or forecasts are not a reliable indicator of future performance. We do not provide investment, legal and/or tax advice. Should this website contain information on the capital market, financial instruments and/or other topics relevant to investment, this information is intended solely as a general explanation of the investment services provided by companies in our group. Please also read our risk information and terms of use.