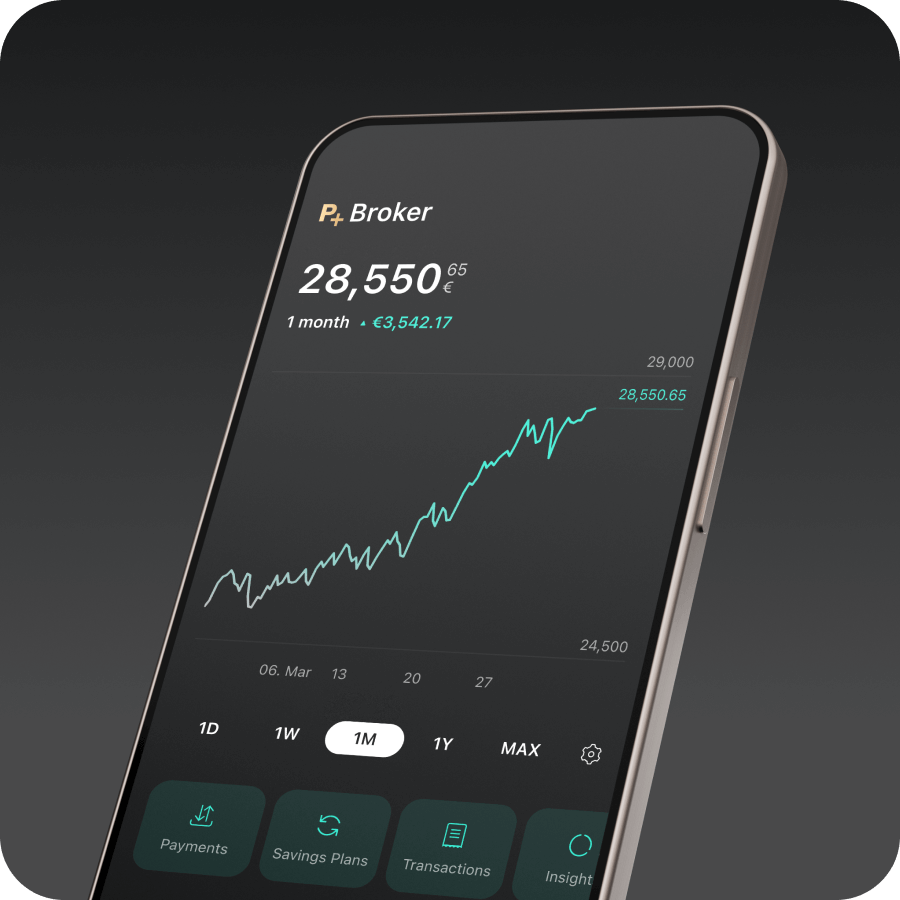

PRIME+ Broker

Flat rate and

2% interest

Unlimited trading1 and 2% interest p.a.* on unlimited cash.

Investing involves risks.

1PRIME+ Broker: €0 for trades of €250 or more, otherwise €0.99. €0 for savings plan executions. Crypto fees, product costs, spreads and/or inducements may apply. Learn more.

PRIME+ Broker – all inclusive

The only broker you need.

PRIME+ features

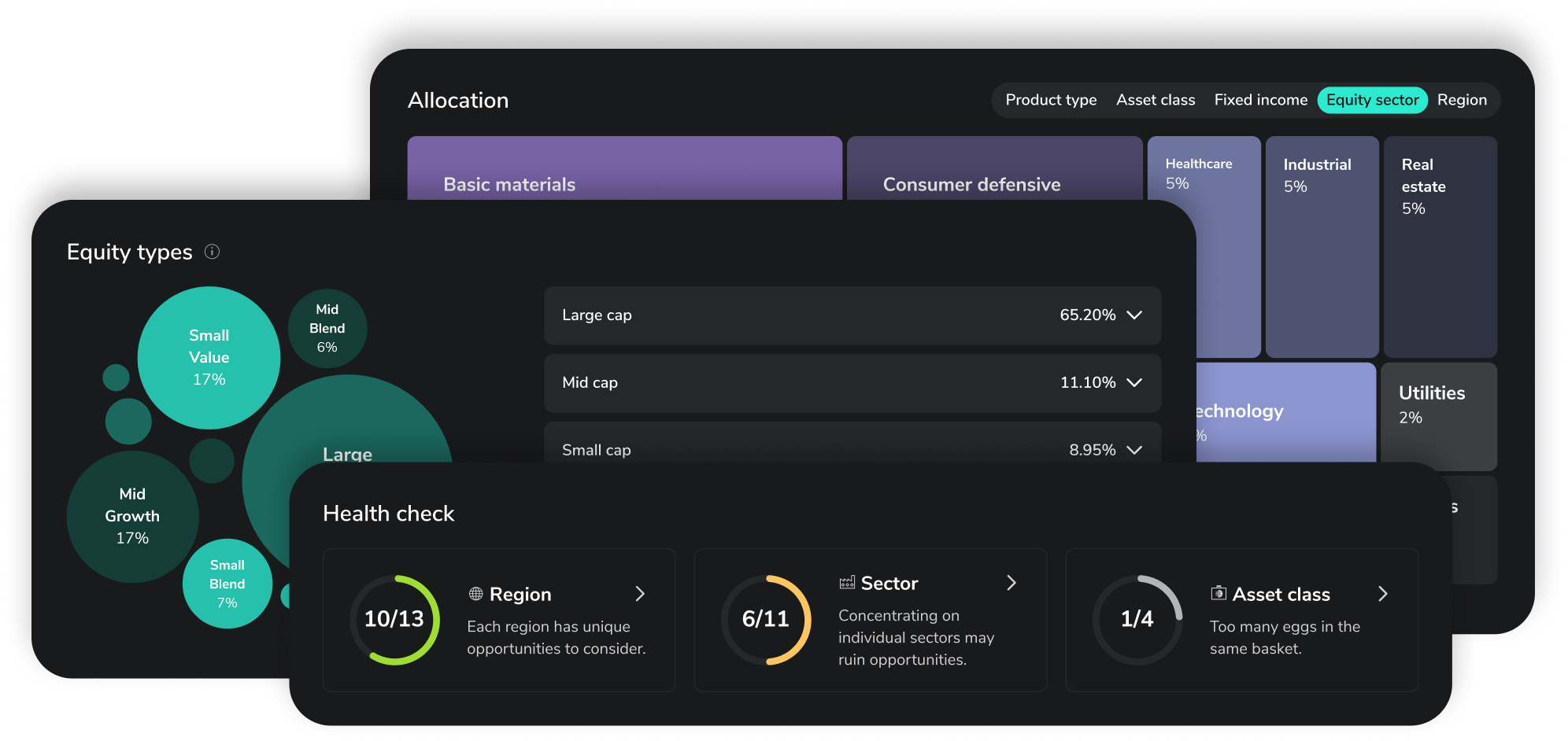

Get the best trading experience with features that make trading easier or optimise your investments.

1 PRIME+ Broker: €0 for trades of €250 or more, otherwise €0.99. €0 for savings plan executions. Crypto fees, product costs, spreads and/or inducements may apply. Learn more.

Even more smart features

In addition to the portfolio analysis tool Insights, other exclusive PRIME+ features enhance your trading experience.

Portfolio groups

Sort your securities the way you like it, e.g. depending on your strategy. Learn more.

Price alerts

Never miss the ideal buying or selling price again. Learn more.

Smart Predict

Find out with which probability your instructed order will be executed within the next hour. Learn more.

Compare securities

Compare the performance, dividends and financial metrics of up to 3 stocks. Learn more.

Easily manage your transactions

Export all Broker transactions to a CSV file with just two clicks. Learn more.

Unlimited trading

Trade as much as you want with the best conditions in the PRIME+ Broker.

Popular |

||

|---|---|---|

FREE |

PRIME+ |

|

Costs 1 |

€0.99 / trade |

€0.00 / trade |

Interest |

2% p.a.* |

2% p.a.* |

Cash distribution |

Scalable, partner banks and |

Scalable and partner banks |

Crypto |

0.99% spread |

0.69% spread |

Advanced features (Portfolio analysis, price alerts and more) |

Limited |

Full version |

1 PRIME+ Broker: €0 for trades of €250 or more, otherwise €0.99. FREE Broker: €0 for purchases of PRIME ETFs (all Amundi, iShares, Xtrackers ETFs) of €250 or more, otherwise €0.99. All broker models: €0 for savings plan executions. Crypto fees, product costs, spreads and/or inducements may apply. Compare broker plans in detail.

Fees in review

At what point are the PRIME+ fees worthwhile? The following example helps to illustrate this.

From 6 trades

PRIME+ can be worthwhile

In one month you conduct 6 trades. This can be purchases or sales with an order volume of at least €250.

This is how PRIME+ pays off:

FREE Broker: You pay order fees of €5.94. | |

PRIME+ Broker: You pay €4.99/month1. This saves you almost €1 compared to the FREE broker. |

1 PRIME+ Broker: €0 for trades of €250 or more, otherwise €0.99. FREE Broker: €0 for purchases of PRIME ETFs (all Amundi, iShares, Xtrackers ETFs) of €250 or more, otherwise €0.99. All broker models: €0 for savings plan executions. Crypto fees, product costs, spreads and/or inducements may apply. Compare broker plans in detail.

Frequently asked questions

You can set up price alerts for all securities and adjust them at any time. To do so, click on the security that you want to set a price alert for. On the overview page of the security, click on the bell icon in the upper right corner. You can create multiple price alerts for the security. The number of active price alerts is indicated by a number on the bell icon.

Smart Predict is a feature used when placing limit or stop orders. It shows the probability of a limit or stop order being executed within the next hour. The probabilities displayed update automatically and in real time when changing the desired price, or if the price of the security fluctuates.

Log in to the Scalable Broker and click the “Create group” button above your portfolio. Name your portfolio group. Now, you can select individual securities from your portfolio and add them to the group. You can edit your group at any time: Simply add or remove securities, rename or delete a group.

For only €4.99 per month, with the PRIME+ Broker, you gain access to a versatile investment platform with commission free trading of stocks, funds, ETFs and ETPs above an order volume of €250 as well as unlimited savings plans. This is topped with an attractive interest rate on your uninvested cash - all in one place. Additionally to the financial advantages, the price model offers exclusive features supporting you to keep the overview over your portfolio or simplify trading.

Clients earn 2% interest p.a.* (variable) on uninvested cash of up to €100,000 in the FREE Broker and unlimited amount in the PRIME+ Broker.

You can switch between the different price models (FREE Broker and PRIME+ Broker) at any time. To do so, go to the "Profile" tab in your customer area. Under "Products" you will find the option to change your broker plan at any time by clicking on "Change plan". Please note that the change will take effect immediately.

Please note: Do not click on "Cancel Broker", as this will cancel your entire securities account; this process cannot be reversed.

The trading flat rate contains commission-free1 savings plans on stocks, ETFs and other exchange-traded products (ETP) and you receive an unlimited number of trades on the European Investor Exchange and on gettex without order fees1 from €250 order volume. Trades below €250 cost €0.99 on the European Investor Exchange and gettex.

1Product costs, spreads, inducements and crypto fees may apply.

Crypto ETPs are subject to a reduced spread surcharge (see below) in trading and in the savings plan. You also receive better conditions for real-time payment with Instant (0.69 %).

For order execution via the Xetra stock exchange, all clients incur a fee of €3.99 per trade plus a trading venue fee (0.01% of the order volume, min. 1.50 €), regardless of the pricing model. The latter covers all third-party costs for trading and settlement. Partial executions are not charged more than once.