New portfolio analytics tool in the Scalable Broker - identify opportunities and risks with “Insights”

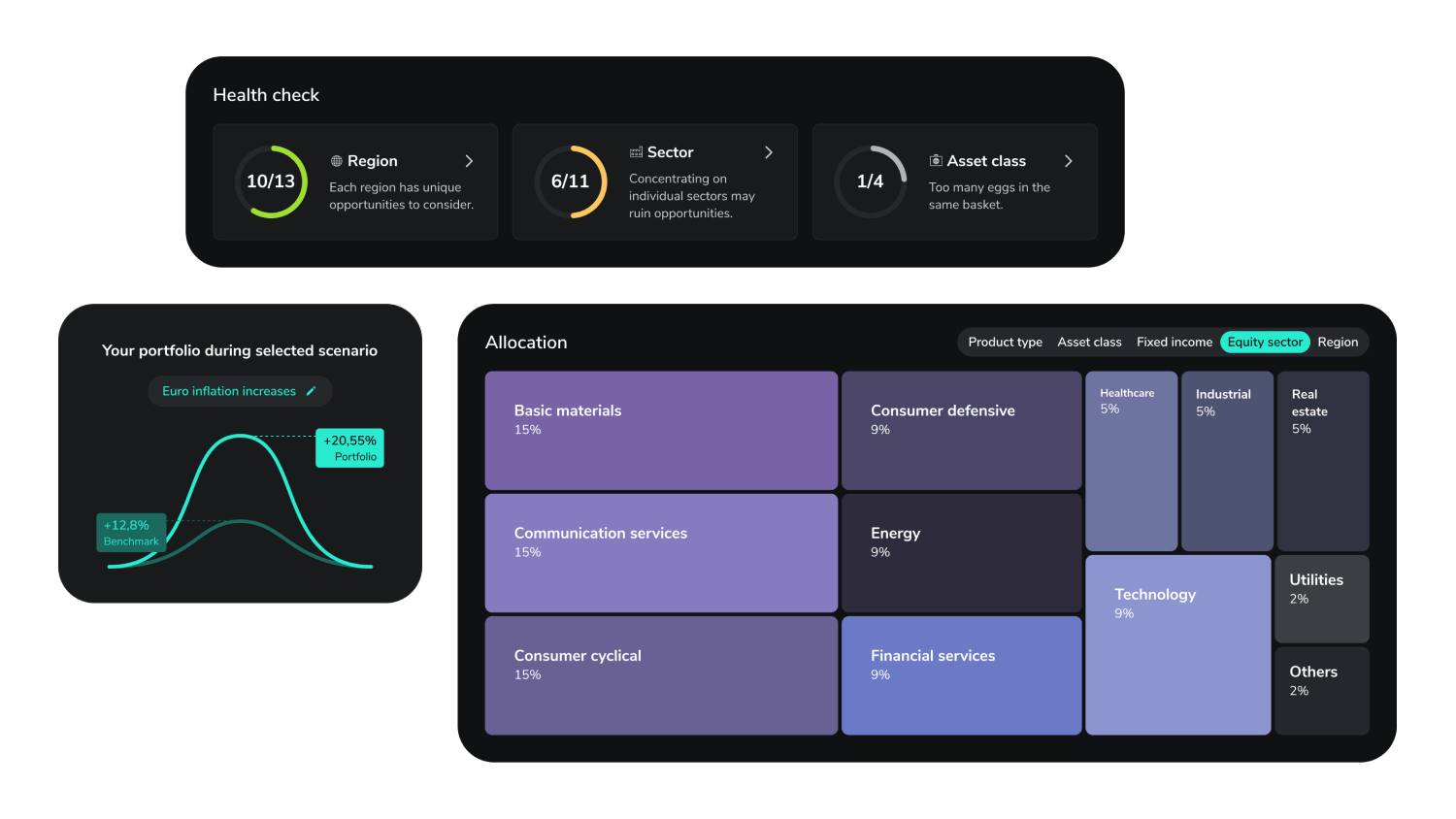

Munich, 19th October 2023 - How does my portfolio cope with rising inflation? Which regions are missing? Does my portfolio face any hidden risks? - The answers to these and many other questions can be provided with “Insights”, the new portfolio analytics tool in the Scalable Broker.

Scalable Capital, a leading investment platform in Europe, expands its broker on the 24th of October to include an extensive suite of analytics features that were previously reserved for professional investors. For the first-time, retail investors will have access to the financial technology of BlackRock, a leading provider of investment solutions and risk management technology. Investors can detect concentration risks in the portfolio and learn how to reduce these through targeted diversification. The scenario simulations illustrate how the portfolio would perform in the event of rising interest rates, high inflation or a stock crash, for example.

Driving independent investment decisions

“The portfolio analysis provides assistance in gaining a better overview of one’s portfolio and making well-informed investment decisions to build wealth over the long term”, explains Julius Weller, Vice President Broker at Scalable Capital. “All in line with our mission to empower everyone to become an investor.”

When investing in multiple ETFs, funds and individual stocks, it can be difficult to keep track of the distribution in regions, sectors or asset classes. With Insights, Scalable Capital creates clarity. For the analysis of the portfolios and the complex calculation of simulations and stress tests, Scalable Capital harnesses the power of BlackRock in portfolio analytics.

“We are excited to partner with Scalable Capital to give retail investors for the first-time access to BlackRock’s financial technology. We want to enable a comprehensive understanding of the whole portfolio, and not just individual investment products. More transparency about opportunities and risks in the portfolio can help more and more people reach better outcomes and experience financial well-being”, says Kai Bald, EMEA Co-Head of Wealth Technology at BlackRock.

Preventive check for the portfolio

The health check gives an indication of whether the portfolio is broadly enough positioned, identifies concentration risks and points out missing or underweighted areas.

Insights is available for PRIME and PRIME+ clients on web and in the apps from the 24th of October. With the FREE Broker, clients get an impression of the wide range of analytics features of Insights. The full range of functions can be tested free of charge at any time.

About Scalable Capital

Scalable Capital is a leading digital investment platform in Europe that makes investing easy and affordable for everyone. Clients of the Scalable Broker can trade 7,800 stocks, 2,500 ETFs, and 3,000 funds and other exchange traded products to build their portfolios, earn interest on their cash balance and take secured loans. The PRIME subscription enables unlimited trading on all orders over 250 euro. Clients in PRIME+ receive an additional 2.6 % per year on uninvested cash up to 100,000 euro. People can also have their investments professionally managed via the digital wealth management service. More than 600,000 clients already use the services.

Scalable Capital was founded in 2014 and is active in Germany, Austria, France, Italy, the Netherlands, Spain, and the UK. The investment firm, which is supervised by BaFin and the Bundesbank, has more than 16 billion euros on its platform. In addition to its business for private clients, the company operates B2B solutions. Its long-standing partners include ING, Barclays Bank in the UK, the robo-advisor Oskar, and the Santander Group in Spain. Scalable Capital employs more than 450 people at its offices in Munich, Berlin, and London. Together with the founding and management team around Erik Podzuweit and Florian Prucker, they strive to empower everyone to become an investor.

More information at: www.scalable.capital

Media contact

Ina Froehner

Scalable Capital

VP Communications and Public Affairs

+49.160.94.43.59.32

press@scalable.capital