Welcome to the Family: Kids’ accounts with Pocket Money now available.

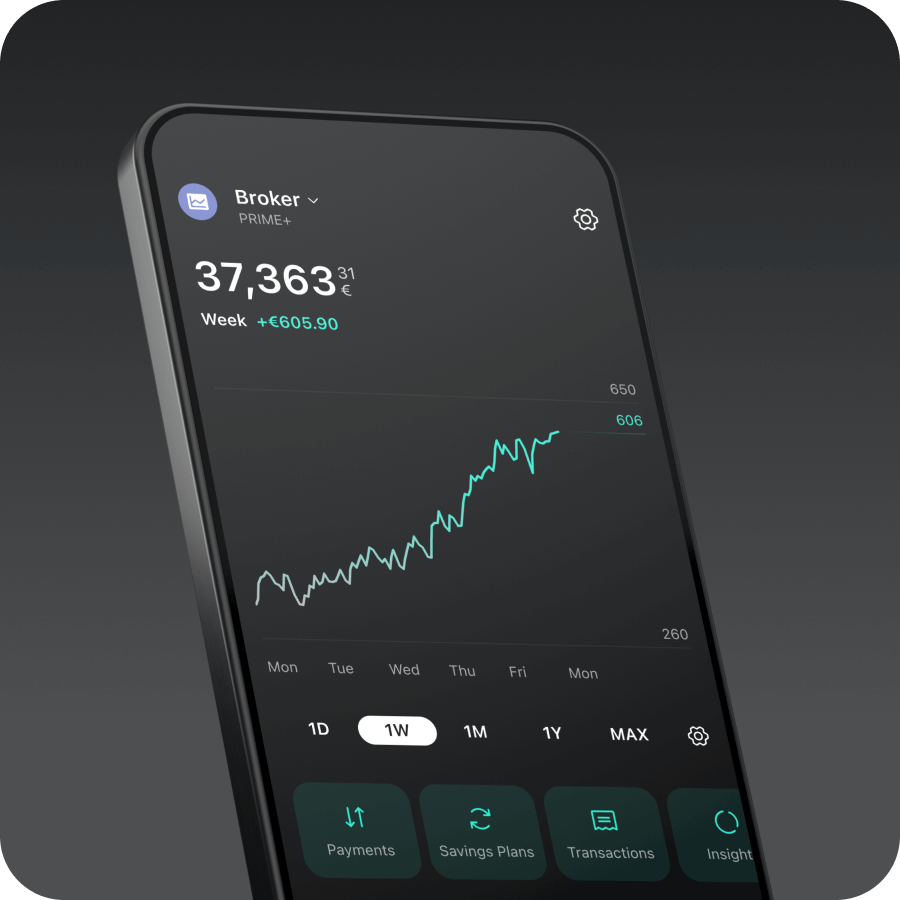

Scalable

Kid’s account

Own your child's future. With Pocket Money on top.

Open an account for all legal guardians first. Afterwards, a Kid’s account can be created.

2% interest p.a.* Interest without the paper and |

|

Pocket Money Invest without the yearly fees |

|

Savings plans Commission-free1 savings plans |

For a better tomorrow

Financial independence starts here.

Start early for long-term success | |

Turn small savings into big dreams | |

Provide lasting independence |

Pocket Money paid by Scalable

In every Kid’s account Scalable pays Pocket Money and reinvests the product costs (TER) back into your Kids’ ETF.

Empower your child's investment future

Pocket Money: Scalable reinvests the product costs (TER) back into your Kids’ ETF | |

Savings plans from €1 savings rate | |

2% interest p.a. on cash* |

FAQ

Answers to further frequently asked questions are answered here.

Scalable reinvests the product costs (TER) back into your Kids’ ETF. On average, €320 in Pocket Money can be earned until the child turns 18.3

By investing for your child now and the account being owned by them, there can be tax savings from early inheritance or gifting depending on the country specific laws.2

All legal guardians need a Scalable account to be able to open a Kid’s account. The account can be opened anytime free of charge. All legal guardians then have full access to the Kid’s account and can manage it.

It is possible to open a Kid’s account even with sole custody.

It is possible to open a Kid’s account even with sole custody.

A Kid’s account can only be opened by the legal guardians.

All legal guardians need a Scalable account. Once your accounts are opened, you can proceed by creating a Kid’s account under Product Overview (double-tap Home) > Add New Product > Create a Kids' Account for my child.

Then, proceed by following the steps for the Scalable Broker for kids, upload the relevant required documents and your account will be ready.

Special conditions apply.

1 PRIME+ Broker: €0 for trades of €250 or more, otherwise €0.99. FREE Broker: €0 for purchases of PRIME ETFs (all Amundi, iShares, Xtrackers ETFs) of €250 or more, otherwise €0.99. All broker models: €0 for savings plan executions. Crypto fees, product costs, spreads and/or inducements may apply. Compare broker plans in detail.

2 Scalable Capital does not provide tax advice. Tax treatment is individual and can change. Assumption: €1,000 saver’s tax allowance, € 12,096 basic tax allowance and €36 special expense tax allowance, capital gains tax: 25%, solidarity surcharge: 5.5%, church tax: 9%.

3 Calculation: Initial investment of €0, monthly savings plan of €50. Assumed return of 7.7%. Quarterly reinvested product costs (TER) of 0.2% until the child turns 18.